SCHEDULE

| Dates | Venue | Category |

| 12-16 June 2023 | Bangkok – Thailand | Audit-Risk Management |

| 20-24 November 2023 | Port Moresby – Papua New Guinea | Audit-Risk Management |

| 27 November-1 December 2023 | Kuala Lumpur – Malaysia | Audit-Risk Management |

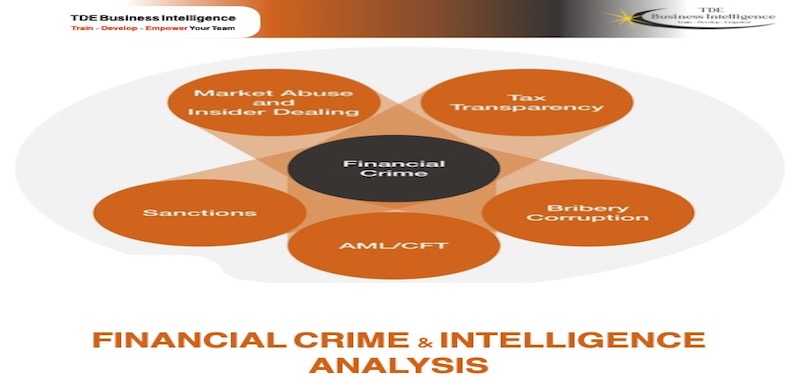

INTRODUCTION

This Financial Crime & Intelligence Analysis training course provides an exciting interactive experience for employees within financial services and the regulated sector to identify the key areas of concern as regards to all facets of financial crime Money Laundering and counter Terrorist Finance.

Working with the subject matter expert, the participants will receive relevant and topical as well as current issues regarding Typologies, Methods and greater awareness of the global problems associated with financial Crime.

This well researched and enthusiastically delivered training course has been designed to combine instructor delivering actual case studies, followed by in depth discussions, exercises and question and answer sessions throughout.

BENEFITS OF ATTENDING

Upon the completion of this training, participants will be able to:

- Understand the key offences of Money Laundering, Terrorist Financing and Financial Crime.

- Review and Analyse case studies through in-depth discussions with instructors.

- Understand the risks to professionals working in AML and Financial Crime areas.

- Apply current knowledge and experience to the exercises provided by the instructors

- Learn and develop new skills and techniques in investigations

WHO SHOULD ATTEND?

- Financial Crime Analysts

- Transaction Monitoring Professionals

- AML and Financial Crime investigations Professionals

- Compliance Professionals

- Financial Investigators

- Fraud Investigators

COURSE MODULES

Session 1: Financial Intelligence

- Financial Intelligence Analysis and assessment

- Trade based money laundering

- Review of a TF case study

- Emerging Threats in Money Laundering

- Financial Intelligence Exercise and debrief

- P2P Emergence Crypto-currency and VASPS

Session 2: The Need for Effective Compliance and Due Diligence

- Sanctions and Sanctions Busting

- Case Study on Round Tripping Fraud

- AML Exercise

- The Principles of the Risk Based Approach

- Case study regarding Government Corruption

- The Roles and Responsibilities of FATF.

Session 3: The Challenges of Counter Terrorist Financing

- State Sponsored Terrorism, a study into Hezbollah

- Government Corruption A case study 1MDB Malaysia

- Professional Money Launderers and Gateways (Lawyers, Notaries, Accountants)

- Cyber Threat and Insider Actors.

- Money Value Transfer Business and MSB’s

Session 4: A Study in the Key Indicators of Extremism

- A case study in Interpretation of Financial data

- CFT Exercise “stop the attack”

- Proliferation and Sanctions breaches.

- Case Study in Terrorist Groups methodologies and motivation.

- Radicalisation and Extremism as seen in Banking data.

Session 5: Conclusion of all Exercises and Debrief

- CFT Exercise (Continued)

- how to investigate PEPS and High Net Worth Beneficial Owners

- Cyber-Crime Typologies

- PEP exercise Establishing True ownership of opaque structures and entities.

- Debrief of the Programme